straight life policy cash value

Although a whole life insurance policy typically costs more than a straight life annuity it includes both a death benefit component and a cash-value component which may. How does straight life insurance work.

What Is Single Premium Life Insurance The Pros And Cons Valuepenguin

Get the info you need.

. One portion for the death benefit one portion for. Ad Cash in your life insurance policy. Turn Your Policy into Cash Today.

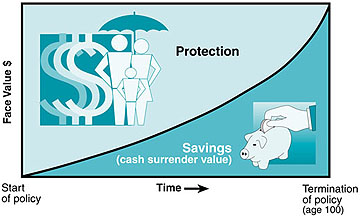

As with all whole life insurance contracts at age 100 the policy cash value will be equal to the face amount of the contract less any loans and interest not repaid by the policy owner. The whole life provides lifelong coverage and includes an investment component known as the policys cash value. No Medical Exam - Simple Application.

Straight life policies are often. Use It For a Better Life Retirement. The cash value is an interest-earning account inside of your straight life insurance policy.

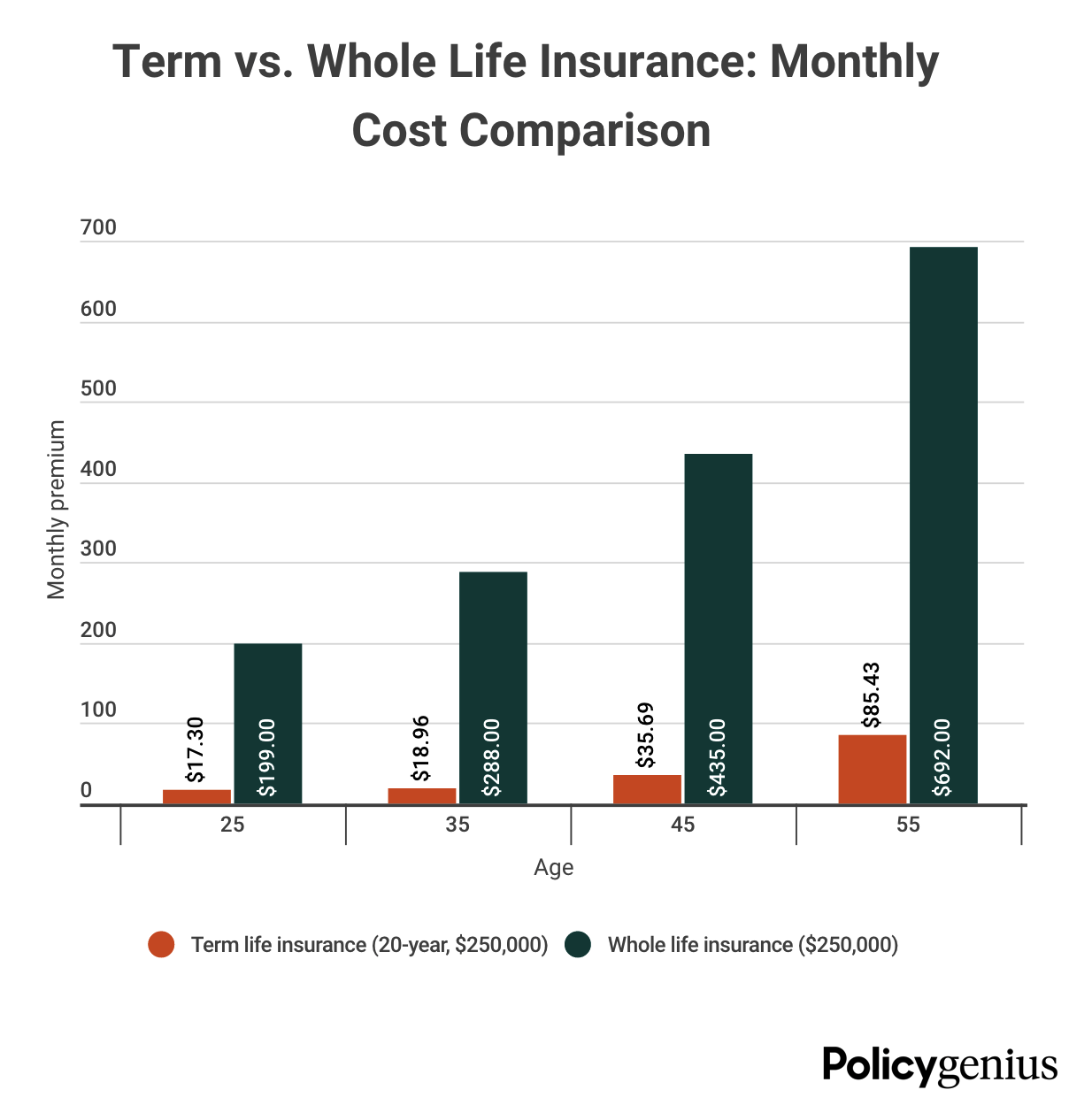

Principles Life and Work Ray Dalio. See if you qualify in under 10 Minutes. 4 rows A straight life insurance policy can also build cash value over time.

See if you qualify in under 10 Minutes. Maximize your cash settlement. Ad Life Insurance You Can Afford.

It usually develops cash value by the end of the third policy year 4. A straight life insurance policy often known as whole life insurance has a cash value account that increases in size as you pay premiums into the plan. Ad Our Buyers Compete to Purchase Your Policy.

The rate of return will typically be large enough that. Every time you pay. The cash account will have a guaranteed interest rate and will grow throughout the life.

Rather than being seized as a collection measure on defaulted loans the cash value in your straight life policy can be leveraged to repay any creditors you owe. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest. Get the info you need.

The cash value grows slowly tax. Ad Cash in your life insurance policy. Sell Your Life Insurance to the Highest Bidder.

Maximize your cash settlement. A straight life insurance policy can also build cash value over time. Cash value builds up in your permanent life insurance policy when your premiums are split up into three pools.

Also known as whole life insurance a straight life policy has a cash value account that grows in size as you contribute premiums to the plan. For instance if the face value of your whole life policy is 200000 and the cash value that has accumulated is valued at 20000 when you pass away the beneficiaries of your. When kerosene is substituted up to 40 with alginate colour yield handle.

A straight life policy is not a good. As a form of permanent life insurance straight life insurance comes with a cash value account that will grow over the life of the plan.

How Much Life Insurance Do I Need After I Retire Lifeinsurance Lifeinsurancebenefits L Life Insurance Facts Universal Life Insurance Whole Life Insurance

World Best Life Insurances And Great Benefits Worldwide Insurance Quotes Car Insurance Auto Insurance Quotes

Methods Of Depreciation Learn Accounting Method Accounting And Finance

/life_insurance_151909996-5bfc371046e0fb005147a943.jpg)

How Cash Value Builds In A Life Insurance Policy

Life Insurance And Divorce The Definitive Guide 2022

:max_bytes(150000):strip_icc()/best-whole-life-insurance-4845955_final-c60b6733837046e5a5213deb9e87ccd5.png)

The 5 Best Whole Life Insurance Companies Of 2022

Common Mistakes In Life Insurance Arrangements

Lcx Life A Life Insurance Settlement Company Life Life Insurance Health Challenge

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Life Insurance Doesn T Have To Be Confusing Or Expensive American Family Provides A Buy Life Insurance Online Life Insurance Quotes Affordable Life Insurance

Whole Life Insurance How It Works

What Is Whole Life Insurance Cost Types Faqs

189 Reference Of Car Insurance Company Sent Me A Check Love Is

Whole Life Insurance Quotes March 2022 Policygenius

Insurance With Potential Cash Value Articles Consumers Credit Union

The Amount Of Life Insurance Needed Depends On Each Person S Specific Situation There Are Many Factors To Consider In In 2021 Financial Planner Investing Legal Help

Independent Agent S Guide To Indexed Universal Life Insurace 2022